Every day, every month, every year, there are more robots in the warehouse.

Last week, for example, DHL Supply Chain announced “a $15 million investment in robotics solutions from Boston Dynamics, the global leader in mobile robotics, to further automate warehousing in North America.” Here are some details from the press release:

The companies have signed a multi-year agreement that begins with equipping DHL facilities with Stretch, Boston Dynamics’ newest robot specifically designed to automate the unloading process in distribution centers.

The investment is part of DHL Supply Chain’s Accelerated Digitalization agenda, a strategy for developing and scaling innovative solutions and new technologies. Stretch will tackle several box-moving tasks in the warehouse, beginning with truck unloading at select DHL facilities. Following the first deployment, the multi-purpose mobile robot will handle additional tasks to support other parts of the warehouse workflow, which will effectively automate warehouse operations.

Also last week, Vecna Robotics, which makes self-driving fork trucks, pallet trucks, and tuggers, announced “a $65 million Series C funding round led by Tiger Global Management, along with additional funding from new investors Lineage Logistics, Proficio Capital Partners, and IMPULSE.” Here is a quote by Craig Malloy, CEO of Vecna Robotics, from the press release:

“There is huge headroom for growth in automated material handling with over 5 billion pallets in the world being moved by more than 5 million forklifts and nearly 5 million manual operators. This investment, led by such a prominent and supportive group of investors, will allow us to accelerate our roadmap and deliver solutions to the market faster in order to meet the insatiable demand [emphasis mine] for increased throughput in material handling environments like factories and warehouses.”

Earlier this month, Exotec announced $335M in Series D funding at a $2B valuation. Exotec’s signature solution, The Skypod system, “utilizes robots that can reach a height of 36 feet to enable high-density inventory storage and retrieval. Exotec supports 30+ industry-leading brands spanning e-commerce, grocery, retail, manufacturing, and 3PL sectors.”

And in a recent Wall Street Journal article, Jennifer Smith highlights how “trucking company ArcBest Corp. and logistics provider NFI Industries Inc. led a $42 million investment to back startup Phantom Auto Inc.’s remote vehicle operation software and plan to deploy thousands of remote-enabled forklifts over the next several years.”

As described in the article, “Phantom’s technology allows off-site drivers to operate equipment using video and audio streams, opening up freight-handling jobs to workers in other regions. Operators can switch between forklifts in different locations depending on demand.”

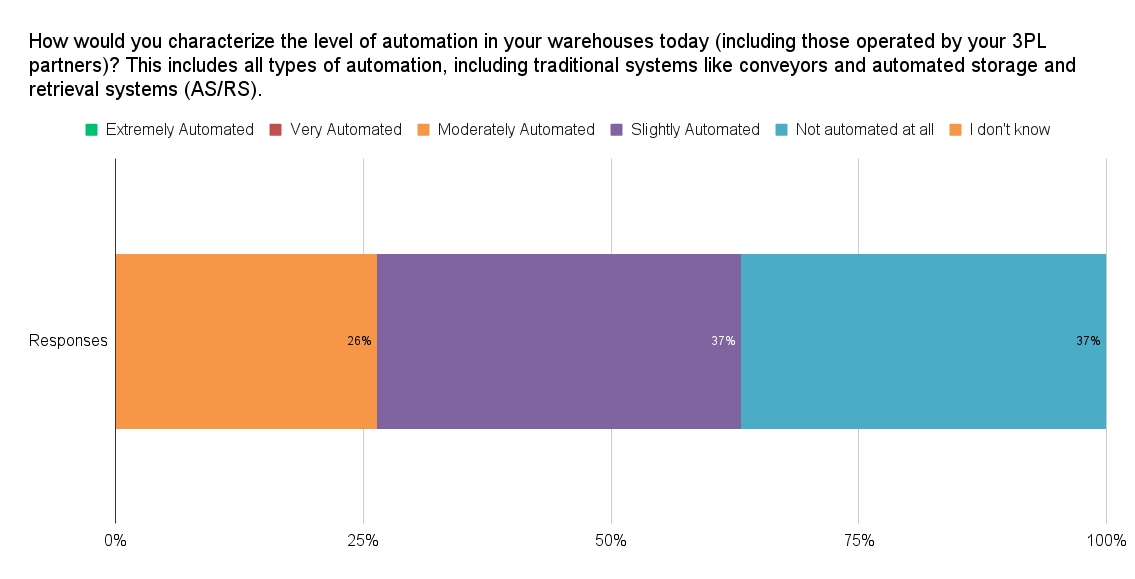

How would you characterize the level of automation in your warehouses today (including those operated by your third-party logistics partners)? We asked members of our Indago supply chain research community that question in August 2021.

Almost three quarters of our member respondents — who are all supply chain and logistics professionals from manufacturing, retail, and distribution companies — said that their warehouses were either only “Slightly Automated” (37%) or “Not automated at all” (37%). None of the respondents said that their warehouses were “Extremely” or “Very Automated.”

Also, almost half of the respondents (47%) said that they are not currently using robotic technology in their warehouses (such as autonomous mobile robots and robotic systems for case or individual item picking) and they have no plans to deploy it in the next 1-3 years; 21% said that they are currently using robotic technology in their warehouses.

“I assume that economics (i.e., the payback on the technology vs. the cost of labor) is the driving force for greater adoption of automation,” said one Indago respondent. “Therefore, labor-intensive activities, such as case picking, are more conducive to the applicability of this type of technology. Our products are full pallet vs. case pick; therefore, this technology is not applicable for us at this time.”

Another member added, “In the past, integrating with our legacy WMS and order management systems has been the biggest barrier for us to implement automation. As we upgrade our technological infrastructure to more modern platforms, we will begin to consider more DC automation.”

Of course, our Indago research community is not representative of the entire market, but the survey results suggest that (at the moment) the need and business case for using robots in the warehouse is stronger in some industries and use cases than in others. And as the quote above indicates, some companies have other priorities at the moment, like modernizing their software systems.

Nonetheless, whether it is driven by a tightening labor supply or a need to cost-effectively scale operations, companies and logistics service providers will almost certainly continue to implement robots and other types of warehouse automation technology in the years ahead.

The question for most companies is not if to implement these technologies, but when.

Join Indago

If you’re a supply chain or logistics practitioner from a manufacturing, retail, or distribution company, I encourage you to learn more about Indago and join our research community. It is confidential, there is no cost to join and the time commitment is minimal (2-5 minutes per week) — plus your participation will help support charitable causes like JDRF, American Logistics Aid Network, American Cancer Society, Feeding America, and Make-A-Wish.

You can also follow us on LinkedIn to stay informed of our latest research results and news.